Update From Valley Peak & Q3 2025 Market Review

As some of you may know, Valley Peak not only manages investment accounts for clients, but also handles tax preparation for businesses and households, and provides internal accounting to businesses and non-profit organizations.

In an effort to provide premier service to our tax preparation clients, we recently welcomed Matt Sherman, CPA to the team. With over fifteen years of tax preparation experience, he brings a wealth of knowledge and capacity to the table. If you or someone you know needs help with taxes or has questions about how the new tax bill may affect their situation, please don’t hesitate to contact us.

Q3 2025 Market Review

It has been quite a wild year for the financial markets, which have continued to press on to all-time highs, despite weakening economic data (stickier inflation, slowing jobs market, ongoing trade wars). In the first three quarters of 2025, the S&P 500 was up 14.8%, and has reached an all-time high twenty-eight times. Interest rates have materially dropped across the year, supporting the bond market and elevated valuations in the stock market. Companies by and large have continued to find ways to grow their earnings, and monetary and fiscal policy have provided the tailwind.

Market Pullbacks Are Normal And To Be Expected

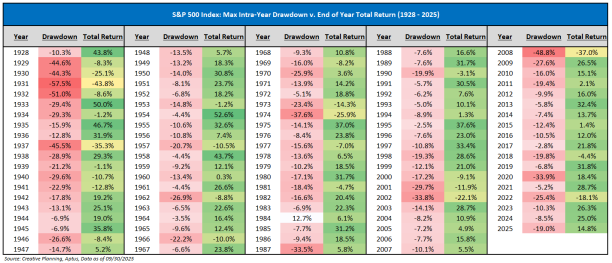

Uncertainty and volatility can be a long-term investor’s best friends. After all, if capturing great returns in the stock market was easy, everyone would do it, and stock prices would be driven to a level at which future returns wouldn’t actually be that great. Being patient through short-term corrections, and even longer-term bear markets, is how a long-term investor achieves successful outcomes. In 2025, the market experienced a sizable pullback (21%) in the second quarter after tariffs were initially announced by the Trump administration. The magnitude of this drawdown is well within the range of typical market behavior. Here are a few statistics that may surprise you:

The market averages three pullbacks of 5% or more each year

Since 1928, the average intra-year drawdown of the S&P 500 has been 16%, yet year-end returns are often positive (see table below)

The last six times the S&P 500 experienced a 10% or greater decline, the index was higher one year later

In the words of Warren Buffett, “Uncertainty actually is the friend of the buyer of long-term values.”

Major Factors at Play

The market this year has been driven by a few high-level themes:

Don’t Fight the Fed

This concept refers to the Federal Reserve’s accommodation to the markets. In September, the Fed cut interest rates and signaled that a new rate-cutting cycle has started. This has historically been very supportive for stock and bond prices.

Federal Government Disruption & Tax Cuts

The Trump Administration began the year by slashing spending and entire departments in the Federal government, in an attempt to reduce wasteful spending and inefficiency. In the process, many Federal employees lost their jobs. It also introduced a slew of tariffs on international goods that sent markets into a tailspin in April.

From that point forward, however, these elements began to turn toward the positive. As countries came to the negotiating table with Treasury Secretary Bessent, tariffs have mostly been lessened. It is also possible that a substantial portion of the collected tariffs will be refunded to companies if the Supreme Court rules that they were illegally implemented.

In addition, The One Big Beautiful Bill Act (OBBBA) was passed, solidifying and boosting tax cuts into the future. The impact of this won’t be fully felt until 2026 and beyond, but more dollars will be left in the pockets of already-strong U.S. consumers. The impact of this in 2026 should be roughly $150 billion of consumer aid.

AI Investment & Enthusiasm

We are certainly in the advent of the AI gold rush, and a $346 billion has been poured into capital expenditure investment by a few large companies (Amazon, Alphabet, Meta, Microsoft, and Oracle) over the last four quarters. Over the next two years, another $500 billion is expected to be spent on AI infrastructure.

While small companies have broadly performed quite well this year, the large company segment of the market (the S&P 500 Index) has been driven almost exclusively by the “Magnificent Seven” stocks, which are all AI-driven technology companies. They include Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. In fact, if you peel apart the returns, here’s what you get in Q3 2025:

Magnificent Seven: 16.9%

S&P 500 Average Stock: 4.8%

These seven companies now command roughly 41% of the index. While that may seem like a lot (and it is), it’s not necessarily cause for alarm. These technology behemoths have widely diversified their products and services over the last couple of decades, which lowers the risk of one piece of their business underperforming and dragging down returns.

International Stock Outperformance

The international stock markets have outpaced U.S. markets this year due to easy monetary policy in Europe and expanding fiscal stimulus. Global investors have begun to seek broader exposure to international stocks after many years of favoring U.S. companies, generally speaking.

Much of the outperformance in 2025 has come from currency translation as the U.S. dollar has weakened. We continue to be underweight international stocks relative to our internal benchmarks, and will seek confirmation of a structural shift in favor of continued outperformance before making any major changes.

Conclusion

We continue to maintain our current course after almost three years of above average stock performance, making minor tweaks to our clients’ portfolios. We welcome a conversation or any questions you may have.

With you for the long haul,

Carter Ellis, CFP®

Founder

Disclosures:

Past performance is no guarantee of future success. This material is for informational use only and should not be considered investment advice.

The opinions expressed are those of Guardian Wealth Advisors, LLC. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed. Investing involves risk. Principal loss is possible.

Investment advisory services offered though Guardian Wealth Advisors, LLC D/B/A Valley Peak Financial. Guardian Wealth Advisors, LLC ("GWA") is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about GWA's investment advisory services can be found in its Form CRS or Form ADV Part 2, which is available upon request. GWA-25-110