Investment Strategy & Ongoing Management

You Need a Team That Understands How to Invest in Uncertain Times

At Valley Peak Financial, our approach to investing is tailored to navigate the complexities of the modern financial landscape with precision and foresight. We bring you strategies grounded in a deep understanding of market dynamics and the pivotal role of risk management. See below for some highlights of our thinking.

-

• Compliance & investment research support provided by Guardian Wealth Advisors & Aptus Capital Advisors

• Independent fiduciary advisor

• Use of custodians Charles Schwab & Capital Group

• Provides investment management and comprehensive financial planning

• Quarterly reporting of performance

• Transparent fee structure

-

• Raleigh-based Registered Investment Advisor

• Back-office billing support

• Securities & Exchange Commission (SEC) compliance resource

-

• Investment research resource

• 12 Chartered Financial Analysts (CFAs) on staff

• Growing team of investment professionals to support our clients

-

Provides tax preparation and accounting services to clients

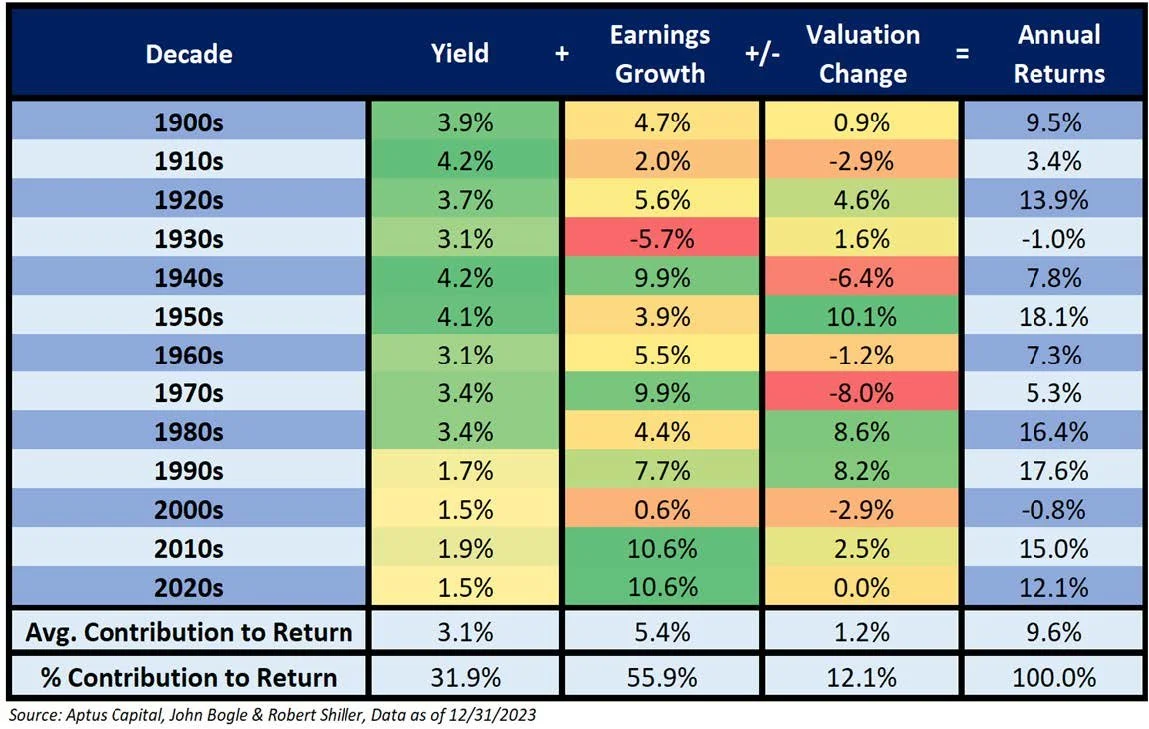

Seeking Growth From…

Dividend Yield

Earnings Growth

Investor Valuation (sentiment)

We see stock market returns from a mix of these components.

Stock Exposure Highlights

US-Focused: under-weight relative to benchmarks as we continue to see stronger fundamentals in domestic equities. Slowing global growth will continue to challenge international equities.

Smaller Cap: small companies are the only asset class to outperform inflation in every decade since the 1930s.

Value-Oriented: we think the market will reward profitable companies with strong free cash flow, and we often find more of these attributes with lower valuations.

The Bucket Approach Framework

The Bucket Approach assures that clients can stick to their long-term plan. By allocating sufficient assets to Buckets 1 & 2, clients can cover living expenses without exposure to significant market volatility (i.e., the risk of losing value when you need it).

Bucket 3 focuses on long term compounding and earning sufficient return (i.e., avoiding the risk of running out of money). Balancing a mix of long-term return drivers and short-term risk-mitigators, clients can be in a position to pursue better outcomes.